CFO Services for Small Business: Why Every Business Needs One

Small business owners often find themselves juggling multiple responsibilities to keep their businesses running. From sales and marketing to operations and finances, it can be overwhelming to manage everything on their own. While many small business owners try to do it all themselves, there comes a point where they need to delegate some tasks to someone else. One of the most important tasks that small business owners need to delegate is financial management. This is where CFO services for small business come in.

The Importance of CFO Services for Small Businesses

Small businesses need CFO services for several reasons. For one, small business owners are often not financial experts. They may be great at running their businesses, but they may not have the necessary skills and expertise to manage finances. Additionally, small business owners may not have the time to devote to financial management. By outsourcing financial management to a CFO, small business owners can free up their time to focus on other areas of their business.

What are CFO Services?

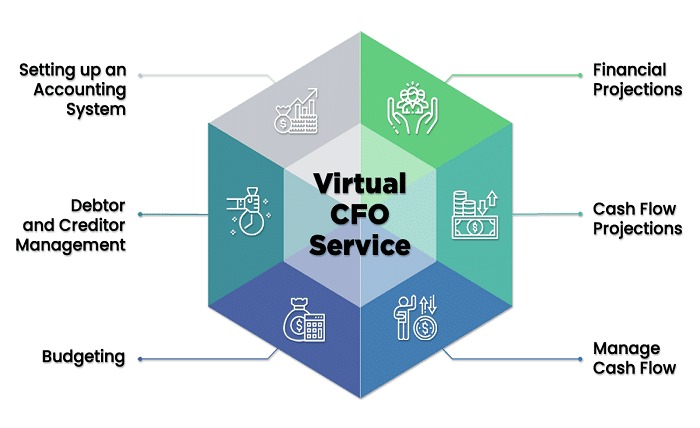

CFO services refer to the financial management services provided by a CFO or Chief Financial Officer. CFOs are responsible for managing a company’s finances and ensuring that the company is financially healthy. CFO services for small business can include financial analysis, budgeting and forecasting, financial reporting, cash flow management, tax planning, and more.

Benefits of CFO Services for Small Businesses

There are several benefits of CFO services for small businesses, including:

- Improved Financial Management: CFOs have the expertise to manage a company’s finances effectively. They can help small business owners make better financial decisions and ensure that their businesses remain financially healthy.

- Better Decision Making: With the help of a CFO, small business owners can make better decisions based on financial data and analysis. This can lead to better business outcomes and increased profitability.

- Reduced Risk: CFOs can help small businesses mitigate financial risks by identifying potential issues and developing strategies to address them.

- Increased Efficiency: By outsourcing financial management to a CFO, small business owners can free up their time to focus on other areas of their business. This can lead to increased efficiency and productivity.

- Cost Savings: CFO services for small business can be more cost-effective than hiring a full-time CFO. Small businesses can save money on salaries, benefits, and other costs associated with hiring a full-time employee.

When Should You Hire a CFO for Your Small Business?

Small businesses may not need a full-time CFO, but there are certain times when it makes sense to hire one. These include:

- Rapid Growth: If your business is growing rapidly, you may need a CFO to help manage your finances and ensure that you are on the right track.

- Financial Challenges: If your business is facing financial challenges, a CFO can help you identify the root cause of the problem and develop a plan to address it.

- Preparation for Sale: If you are preparing to sell your business, a CFO can help you prepare your financial statements and ensure that your business is attractive to potential buyers.

- Cash Flow Management: If your business is struggling with cash flow, a CFO can help you develop strategies to improve cash flow and ensure that you have enough money to operate your business.

Conclusion

In conclusion, CFO services for small business are essential for the financial health and success of small businesses. By outsourcing financial management to a CFO, small business owners can focus on other areas of their business while ensuring that their finances are in good hands. CFOs can help small businesses make better financial decisions, reduce risk and improve efficiency and profitability. Small businesses may not need a full-time CFO, but there are certain times when hiring a CFO makes sense, such as during periods of rapid growth, financial challenges, preparation for sale, and cash flow management.