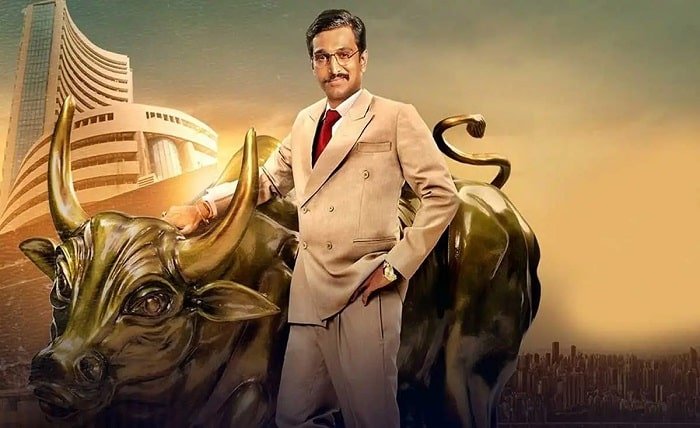

Harshad Mehta Bull Run: A Tale of Greed and Fraud

The Indian stock market has witnessed many booms and busts in its history, but none as dramatic and notorious as the Harshad Mehta bull run of the early 1990s. Harshad Mehta, a Bombay-based stockbroker, had become a familiar name on Dalal Street during that period, as he orchestrated a massive rally in share prices, making himself and his clients rich in the process.

However, his meteoric rise was soon followed by a spectacular fall, as he was exposed as the mastermind behind one of the biggest financial frauds in Indian history, involving manipulation of bank receipts and siphoning off funds from the banking system to fuel his speculative bets.

In this blog post, we will take a closer look at the Harshad Mehta bull run, how it unfolded, what were the loopholes that enabled it, what were the consequences and lessons learned from it, and how it compares to the current market scenario.

Read more about harshad-mehta-bull-run rajkotupdates.news

How did Harshad Mehta become the Big Bull?

Harshad Mehta was born on 29 July 1954 in Paneli Moti, Rajkot district, in a Gujarati Jain family. His early childhood was spent in Borivali, where his father was a small-time textile businessman. He did his B.Com in 1976 from Lala Lajpatrai College, Bombay and worked a number of odd jobs for the next eight years, including selling hosiery, cement, and sorting diamonds. He started his career as a sales person in the Mumbai office of New India Assurance Company Limited (NIACL).

In the early 1980s, he moved to a lower level clerical job at the brokerage firm Harjivandas Nemidas Securities where he worked as a jobber for the broker Prasann Pranjivandas Broker who he considered his “Guru”. Over a period of ten years, beginning 1980, he served in positions of increasing responsibility at a series of brokerage firms. By 1990, he had risen to a position of prominence in the Indian securities industry, with the media (including popular magazines such as Business Today) touting him as “Amitabh Bachchan of the Stock market”. He set up his own firm called Grow More Research and Asset Management, with the financial assistance of associates, when the BSE auctioned a broker’s card.

By early 1990, a number of eminent people began to invest in his firm, and utilize his services. He had a loyal following of investors who trusted his stock picks and advice. He also had access to large amounts of funds from banks and financial institutions through a complex web of transactions involving bank receipts (BRs). BRs were used in short-term bank-to-bank lending, known as “ready forward” transactions, which Mehta’s firm brokered. These transactions were supposed to be secured by government securities as collateral, but Mehta found a way to bypass this requirement by using fake or forged BRs issued by small and cooperative banks that did not have any government securities to lend. He then used these funds to buy large quantities of shares of select companies, creating an artificial demand and driving up their prices. He also spread rumors and positive news about these companies to attract more buyers and inflate their valuations.

By doing this, he created a bull run in the stock market that lasted from 1990 to 1992. The BSE Sensex rose from around 800 points in January 1990 to over 4500 points in April 1992, a gain of over 450%. Mehta’s personal wealth also soared, and he flaunted it by buying expensive cars, bungalows, and jewellery. He was hailed as a hero and a genius by many investors who made huge profits by following his tips. He also enjoyed political patronage and influence, and was seen hobnobbing with celebrities and businessmen.

How was the Harshad Mehta scam exposed?

The Harshad Mehta scam was exposed by a series of events that started in April 1992. The first trigger was the tightening of money supply by the Reserve Bank of India (RBI) to curb inflation. This made it difficult for Mehta to get funds from the banks to continue his buying spree. He also faced margin calls from the brokers as the stock prices started to decline.

The second trigger was the revelation of a Rs 600 crore scam in the State Bank of India (SBI), involving the diversion of funds from its securities division to Mehta’s account. This was done by issuing fake BRs to Mehta in exchange for cheques drawn on his account in Bank of Karad (BOK), a small cooperative bank. The cheques were never cleared, and the BRs were never backed by any government securities. The scam came to light when the RBI asked SBI to verify its BR transactions, and found out that they were bogus. The RBI also discovered that BOK had issued BRs worth over Rs 1200 crore to Mehta without any collateral.

The third trigger was the expose by journalist Sucheta Dalal in The Times of India, who broke the story of how Mehta had manipulated the stock market using BRs and siphoned off funds from the banking system. She also revealed how he had bribed bank officials and politicians to facilitate his scheme.

The fourth trigger was the confession by Mehta himself, who admitted to his role in the scam in a press conference on 23 April 1992. He claimed that he had not done anything illegal, but only exploited the loopholes in the system. He also accused several other brokers, bankers, industrialists and politicians of being involved in the scam, and named some of them. He said that he was ready to cooperate with the authorities and return the money he had taken from the banks.

What were the consequences and lessons learned from the Harshad Mehta scam?

The Harshad Mehta scam had a devastating impact on the Indian economy and society. Some of the consequences and lessons learned from it are:

- The stock market crashed as investors lost confidence and faith in the system. The BSE Sensex plunged from over 4500 points in April 1992 to below 2500 points in August 1992, a loss of over 40%. Thousands of investors lost their savings and livelihoods, and some even committed suicide.

- The banking sector suffered a huge blow as many banks incurred losses due to their exposure to Mehta’s fraud. The RBI had to bail out some of these banks by providing liquidity support and restructuring their debts. The credibility and reputation of the banking system was severely damaged.

- The government faced a political crisis as many ministers and bureaucrats were accused of being involved or complicit in the scam. The then Prime Minister P.V. Narasimha Rao’s government survived a no-confidence motion by a narrow margin in July 1992. Several inquiries and investigations were launched by various agencies such as the CBI, JPC, CAG etc., but none of them could conclusively establish the extent and nature of political involvement in the scam.

- The regulatory framework for the securities market was overhauled and strengthened to prevent such scams from happening again. The Securities and Exchange Board of India (SEBI) was given more powers and autonomy to regulate and supervise the market participants and activities. New rules and guidelines were introduced to improve transparency, accountability, disclosure, governance, risk management etc., in the securities market.

- The public awareness and education about the stock market increased as people realized the importance of financial literacy and due diligence before investing their money. Many investors became more cautious and skeptical about following tips or rumors blindly, and sought professional advice or research before making investment decisions.

How does the Harshad Mehta bull run compare to the current market scenario

The current market scenario in India is quite different from the Harshad Mehta bull run of the early 1990s, in terms of the factors that are driving the market performance, the regulatory environment, and the investor behavior. Some of the key differences are:

- The current market rally is driven by a combination of factors such as strong corporate earnings, economic recovery, global liquidity, vaccine optimism, policy reforms, etc., rather than by manipulation or fraud by a single individual or entity. The market breadth and depth are also much higher, with participation from a diverse set of investors, sectors, and companies.

- The current regulatory framework for the securities market is much more robust and effective, with SEBI playing an active role in monitoring and enforcing compliance, preventing malpractices, protecting investor interests, and promoting market development. The use of technology and digital platforms has also enhanced the transparency, efficiency, and accessibility of the market.

- The current investor behavior is more informed and rational, with a greater emphasis on fundamentals, valuation, diversification, and long-term investing. The investors are also more aware of the risks and rewards of investing in the stock market, and have access to various sources of information, education, and guidance.

However, this does not mean that the current market scenario is free from challenges or risks. Some of the potential risks that could derail the market rally are:

- The uncertainty and volatility caused by the COVID-19 pandemic and its impact on the health and economic situation of the country and the world.

- The inflationary pressures and rising commodity prices that could affect the profitability and growth prospects of various sectors and companies.

- The geopolitical tensions and trade conflicts that could disrupt the global trade and investment flows and affect the sentiment and stability of the market.

- The regulatory changes and policy interventions that could have unintended or adverse consequences on the market functioning or performance.

Therefore, it is important for investors to be vigilant and prudent while investing in the stock market, and not get carried away by greed or fear. They should also follow some basic principles such as:

- Do your own research and analysis before investing in any stock or scheme, and do not rely on tips or rumors from unverified sources.

- Invest only in quality companies with sound fundamentals, strong management, good governance, and sustainable growth potential.

- Diversify your portfolio across different sectors, segments, geographies, and asset classes to reduce your risk exposure and enhance your returns.

- Have a clear investment objective, horizon, strategy, and plan, and stick to it regardless of the market fluctuations or noise.

- Review your portfolio periodically and rebalance it according to your changing needs, goals, risk appetite, and market conditions.

The Harshad Mehta bull run was a historic event that taught us many valuable lessons about the stock market. It also showed us how one man’s greed and fraud can have far-reaching consequences for the economy and society. By learning from this episode, we can avoid repeating the same mistakes in the future, and make better investment decisions for ourselves and our country.