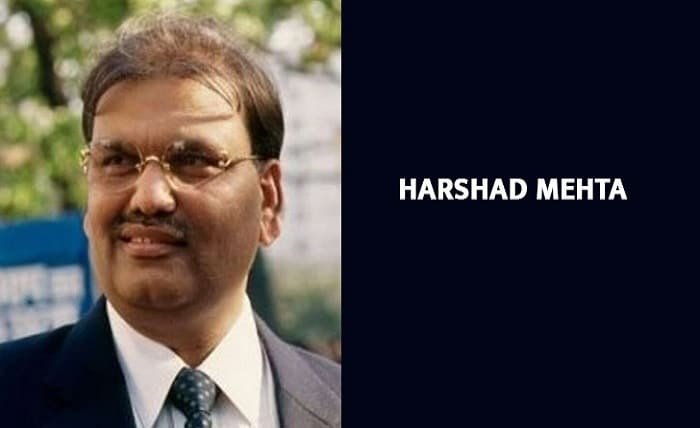

Harshad Mehta, frequently alluded to as the “Large Bull” of the Indian securities exchange, was a polarizing figure whose life and profession made a permanent imprint on India’s monetary scene. Brought into the world on July 29, 1954, in Rajkot, Gujarat, Mehta’s excursion from a modest community kid to an unmistakable stockbroker and then, at that point, to a sentenced criminal is a story that has entranced and stunned a large number.

Mehta’s ascent to popularity started in the last part of the 1980s when he acquired unmistakable quality in the Bombay Stock Trade (BSE). He was known for his forceful exchanging systems and imaginative techniques, which drove him to amass gigantic abundance. He turned into an image of India’s blossoming financial changes and the valuable open doors they introduced to the people who could explore the perplexing universe of money.

Harshad Mehta, frequently alluded to as the “Huge Bull” of the Indian securities exchange, was a polarizing figure whose life and vocation made a permanent imprint on India’s monetary scene. Brought into the world on July 29, 1954, in Rajkot, Gujarat, Mehta’s excursion from a modest community kid to an unmistakable stockbroker and then, at that point, to a sentenced criminal is a story that has entranced and stunned a large number.

Be that as it may, Mehta’s brilliant ascent was brief. As his exercises went under examination, it was uncovered that he had deceitfully gotten assets from banks and controlled the financial framework to fund his stock buys. The Protections and Trade Leading group of India (SEBI) and different policing sent off examinations, and in 1992, Mehta was captured and accused of various monetary wrongdoings.

One of Mehta’s most notorious plans was the “financial exchange trick” of 1992, which shook the whole country. He controlled the financial exchange through a training known as “roundabout exchanging,” where offers were purchased and offered among a gathering of merchants to misleadingly swell their costs. This brought about an enormous securities exchange blast, with the Sensex, India’s securities exchange record, taking off to remarkable levels. Mehta turned into a legend to numerous financial backers and was praised for his clear capacity to make abundance out of nowhere.

The ensuing preliminary and legal actions uncovered the degree of Mehta’s monetary controls and the shortcomings in India’s monetary administrative structure. Mehta was indicted and condemned to jail, where he invested energy before his demise in 2001.

Aatur (Harshad mehta son)

Aatur Harshad Mehta is the child of Harshad Mehta, the scandalous stockbroker who was engaged with the 1992 Indian protections trick. Aatur, similar to his dad, is likewise a finance manager, financial backer, and business visionary situated in Mumbai, India. Notwithstanding, dissimilar to his dad, who was known as the “Enormous Bull” of the Bombay Stock Trade, Aatur likes to stay under the radar and keep away from public consideration.

Aatur was brought into the world in the last part of the 1980s or mid 1990s, and he was as yet a young man when his dad passed on from a coronary episode in 2001. He acquired his dad’s abundance and resources, which were under prosecution for quite a long time. He likewise acquired his dad’s enthusiasm for the financial exchange and turned into an expert stockbroker himself. He has put resources into different areas, like materials, land, and innovation.

One of his remarkable speculations was in Fair Arrangement Fibers, a material organization recorded on the Bombay Stock Trade. In 2018, he purchased a 23% stake in the organization for Rs. 2.9 crore. He likewise set up his own business in Mumbai, however the subtleties of his endeavor are not known to general society. He isn’t dynamic on any virtual entertainment stage and doesn’t give meetings or disclose appearances.

Aatur is hitched and has his very own group. He lives in an extravagant loft in Mumbai’s Worli region. He is likewise near his uncle Ashwin Mehta, who is an attorney and assisted him with clearing his dad’s lawful cases. Aatur has attempted to continue on from quite a while ago and cut his own personality in the business world. He is an effective and well off business person who has gained from his dad’s mix-ups and accomplishments.

Also read more about >> Harshad Mehta Bull Run: A Tale of Greed and Fraud

Harshad mehta scam

The Harshad Mehta scam was one of the biggest financial frauds in India’s history. It involved the manipulation of the stock market by using fake bank receipts and forged documents. Here are some facts about the scam:

- Harshad Mehta was a stockbroker who rose to notoriety and fortune in the last part of the 1980s and mid 1990s. He was known as the “Enormous Bull” or the “Amitabh Bachchan” of the Indian securities exchange.

- He utilized a plan called “prepared forward” to get cash from banks utilizing bank receipts (BRs) as security. BRs should be upheld by government protections (G-Secs), however Mehta acquired them from more modest banks with practically no G-Secs.

- He then, at that point, utilized the acquired cash to purchase portions of different organizations and swell their costs falsely. He likewise impacted different financial backers to follow his wagers and made a securities exchange blast.

- He created a colossal gain by selling the offers at excessive costs and returning the cash to the banks. Notwithstanding, when his extortion was uncovered, he neglected to repay the banks and left them with useless BRs.

- The trick was assessed to be worth around Rs 4,000 crore (US$1.3 billion) and it caused an accident in the securities exchange in 1992. It additionally uncovered the escape clauses and debasement in the financial framework and the protections market.

- Mehta was captured and accused of 74 criminal offenses. He passed on from a respiratory failure in 2001 while he was still in care. His trick prompted a few changes and guidelines in the Indian monetary area.

Harshad mehta net worth

Harshad Mehta was a well known and questionable Indian stockbroker who was engaged with a monstrous protections trick in the mid 1990s. He made a fortune by controlling the financial exchange and getting cash from banks utilizing counterfeit receipts. He was captured and accused of a few lawbreaker and common cases, and kicked the bucket in 2001 while still in care.

The specific total assets of Harshad Mehta isn’t known, as he had numerous resources and liabilities that were under case for a really long time. Nonetheless, a few sources have assessed his total assets to be more than $480 million, which is comparable to be more than ₹3566 crore in Indian rupees. This sum incorporates his pay from his stockbroking firm, his interests in different organizations, and his properties and extravagance vehicles.

Notwithstanding, his total assets likewise experienced an enormous downfall after his trick was uncovered and he needed to take care of the banks and the financial backers. He additionally confronted numerous fights in court and fines that depleted his riches. His family acquired his resources and liabilities, however they likewise needed to battle for their freedoms in court. His significant other, Jyoti Mehta, as of late won a body of evidence against an intermediary who owed ₹6 crore to her late spouse.

Harshad mehta house

Harshad Mehta was a famous stockbroker who was engaged with a gigantic protections trick in 1992. He amassed an enormous fortune by controlling the securities exchange and carried on with a luxurious way of life. One of the most striking parts of his way of life was his home in Mumbai, which was an embodiment of extravagance and luxury.

Harshad Mehta claimed eight interconnected lofts in Madhuli Society, an opulent private complex in Worli. The lofts were ocean confronting and spread north of two stories, covering an area of in excess of 12,500 square feet. The house had a little theater, a pool, a pool room, and a small scale fairway. These conveniences were unbelievable in India around then and mirrored Mehta’s lavish taste and riches.

Harshad Mehta likewise possessed two different pads in Vandana CHS on Janki Kutir Street, Juhu. Every level was 1,150 square feet in size and had a stunning ocean view. He likewise had an office in Producer Chambers at Nariman Point, where he ran his stockbroking firm Growmore Exploration and Resources The board.

Harshad Mehta’s home was his home as well as his superficial point of interest. He facilitated sumptuous gatherings and engaged famous people, government officials, and financial specialists at his home. He likewise showed his assortment of costly vehicles, like Lexus, Mercedes Benz, Honda Accord, and Hindustan Engines Contessa, in his carport. His home was a declaration to his prosperity and power in the financial exchange. In any case, it likewise turned into an objective of examination and seizure after his trick was uncovered and he was captured. His home was unloaded by the specialists to recuperate the misfortunes brought about by his extortion.

Harshad mehta wife

Harshad Mehta’s wife is Jyoti Mehta, an Indian woman who was married to the infamous stockbroker who was involved in the 1992 Indian securities scam. Here are some facts about her:

- Jyoti Mehta and Harshad Mehta were neighbors and experienced passionate feelings for during Navratri playing dandiya-raas during the 1980s.

- They got hitched on 17 May 1977 and had a child named Atur Harshad Mehta.

- Jyoti Mehta was a homemaker until her better half was captured by the Focal Department of Examination (CBI) in 1992 for misusing cash from banks and controlling the securities exchange.

- After Harshad Mehta’s death in 2001 due to a heart attack in prison, Jyoti Mehta inherited his wealth and assets, which were under litigation for years.

- Jyoti Mehta faced a few legitimate conflicts to guarantee the cash that her significant other reserved the options to. In 2019, she won a body of evidence against Government Bank and stockbroker Kishore Janani, who owed around six crore rupees to Harshad Mehta starting around 1992.

- Jyoti Mehta also launched a website named harshadmehta.in in 2022, where she wanted to disclose the side of the story from her family’s perspective.

- Jyoti Mehta isn’t dynamic on any web-based entertainment stage and doesn’t give meetings or unveil appearances. She likes to stay under the radar and keep away from media examination.

- Some reports have claimed that Jyoti Mehta and her son have moved to the United States of America, but this has not been confirmed.

Harshad mehta death

Harshad Mehta was a popular and disputable Indian stockbroker who was engaged with a huge protections trick in 1992. He made a fortune by controlling the financial exchange and getting cash from banks utilizing counterfeit receipts. He was captured and accused of a few crook and common cases, and kicked the bucket in 2001 while still in guardianship.

Here are some facts about Harshad Mehta’s death:

- Harshad Mehta was serving his term in the Thane Prison when he complained of severe chest pain and was taken to Thane Civil Hospital.

- On 31 December 2001, Harshad Mehta died of a heart ailment in the hospital. He was 47 years old at the time of his death.

- Harshad Mehta had 27 criminal charges against him, but he was only convicted of four before his death. He was also facing more than 600 civil action lawsuits filed by banks, investors, and companies.

- Harshad Mehta’s death caused a lot of speculation and controversy, as some people believed that he was murdered or poisoned by his enemies or rivals. However, there was no evidence to support these claims.

- Harshad Mehta’s death also left many questions unanswered, such as the whereabouts of his missing money, his alleged bribe to the then Prime Minister P.V. Narasimha Rao, and his involvement in other scams.

- Harshad Mehta’s death also affected his family, who inherited his assets and liabilities. His wife Jyoti Mehta and his son Aatur Harshad Mehta had to fight for their rights in court for many years.

Final words about Harshad Mehta

Harshad Mehta was a stockbroker who rose to notoriety and fortune in the Indian securities exchange in the last part of the 1980s and mid 1990s. He utilized a fake plan to get cash from banks and put resources into shares, making a market blast and a privately invested money of more than $480 million. Be that as it may, his trick was uncovered in 1992, prompting a market decline and a deficiency of confidence in the monetary framework. He was captured and had to deal with various crook and common penalties, however passed on from a coronary failure in 2001 preceding his cases were settled. His family acquired his resources and liabilities, yet additionally needed to battle for their privileges in court. Harshad Mehta’s trick was quite possibly of the greatest monetary misrepresentation in India’s set of experiences, and it lastingly affected the Indian economy, society, and legislative issues. He was likewise a disputable figure who was respected by some for his desire and knowledge, yet disdained by others for his ravenousness and contemptibility.

Relevant post

Harshad Mehta

harshad-mehta-bull-run rajkotupdates.news