Navigating Market Movements: Decoding the Forex Factory Economic Calendar

For forex traders, staying ahead of the curve is crucial. The Forex Factory Economic Calendar serves as a valuable tool, offering a comprehensive overview of upcoming global events that can significantly impact currency valuations. This blog post will delve into the calendar’s functionalities, benefits, and how to utilize it effectively in your trading strategy.

Unveiling the Calendar: A Trader’s Roadmap

The Forex Factory Economic Calendar provides a clear and concise schedule of upcoming economic events from around the world, categorized by:

- Date and Time: This clearly indicates the date and time of the event in various time zones, facilitating international use.

- Event: Briefly describes the economic event, such as interest rate announcements, employment reports, or manufacturing data releases.

- Importance: Each event is assigned an “importance” rating (high, medium, or low) based on its potential impact on the market.

- Forecast: Presents the anticipated outcome of the event, providing a benchmark for potential market reactions.

- Previous: shows the previous reading of the same data point, allowing traders to compare and assess potential deviations.

- Actual: Once the event occurs, the actual outcome is displayed, enabling traders to analyze the market’s reaction against expectations.

Benefits for Informed Trading Decisions

The forex factory Economic Calendar empowers traders with several key advantages:

- Proactive Approach: By anticipating upcoming events and their potential impact, traders can adjust their strategies accordingly, potentially avoiding losses and capitalizing on opportunities.

- Identifying Market Drivers: Understanding the events driving currency valuations allows traders to make informed decisions based on fundamental analysis, which considers economic health and global factors.

- Gauging Market Sentiment: By observing market reactions to past events and comparing them to forecasts, traders can gain insights into current market sentiment and potential future movements.

Utilizing the Calendar Effectively: More Than Just Dates

To derive the most benefit from the Forex Factory Economic Calendar, it’s crucial to utilize it effectively.

- Refine your filter: Customize the calendar to display events relevant to your trading interests and specific currency pairs.

- Analyze the Data: Don’t solely rely on forecasts; delve deeper into the data and understand the potential implications of each event based on fundamental analysis and historical trends.

- Combine with Other Resources: Integrate the calendar with other tools like news analysis and technical indicators for a holistic understanding of market movements.

Beyond the Calendar: A Holistic Approach

While the Forex Factory Economic Calendar is a valuable tool, remember:

- The market is dynamic. Economic data is just one piece of the puzzle. Stay informed about ongoing news and global events that can unexpectedly influence market sentiment.

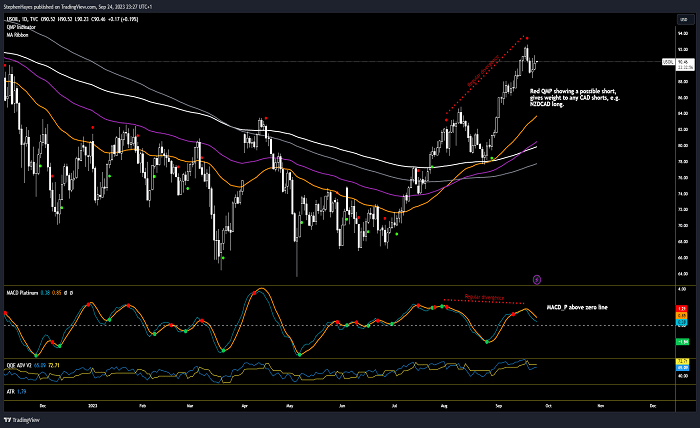

- Technical Analysis: Don’t dismiss technical analysis, which studies historical price patterns and chart indicators, to gain additional insights into potential future movements.

- Risk Management: Regardless of your strategy, prioritize risk management practices like setting stop-loss orders and managing position sizes responsibly.

Conclusion

The Forex Factory Economic Calendar, when utilized effectively alongside other tools and a comprehensive understanding of the market, empowers forex traders with valuable insights to navigate the dynamic and complex world of currency trading. Remember, success in forex trading demands dedication, knowledge, and a responsible approach to managing risk.