Effects of Insider Trading on Company Reputation

Insider trading can devastate a company’s reputation, leading to loss of trust, legal troubles, and financial instability. Understanding its impact is crucial for businesses aiming to maintain integrity and stakeholder confidence. Let’s explore how insider trading erodes trust, affects market stability, and damages public perception, using real-world examples to highlight the stakes involved. Additionally, if you want to know more about investments and firms, you may visit https://immediate-mentax.org/

Mechanisms of Damage: How Insider Trading Erodes Trust

Insider Trading as a Breach of Fiduciary Duty

When company insiders trade based on non-public information, it’s a clear breach of fiduciary duty. Fiduciary duty means acting in the best interest of the company and its shareholders. Insider trading shatters this trust. Imagine a captain steering a ship for their benefit, leaving passengers in peril. That’s what insider trading feels like. The insiders profit while regular investors bear the risks.

The Role of Trust in Stakeholder Relationships

Trust is the glue that holds stakeholder relationships together. Shareholders, employees, and customers all rely on the integrity of a company’s leadership. When insider trading occurs, it signals that those at the top are willing to put their interests above everyone else’s.

This can lead to a domino effect, where confidence in the company erodes across all levels. Imagine you find out a close friend has been lying to you for personal gain. Your trust would be shattered, right? The same happens in companies; stakeholders start to question the company’s values and reliability, potentially leading to decreased investments, lower employee morale, and lost customers.

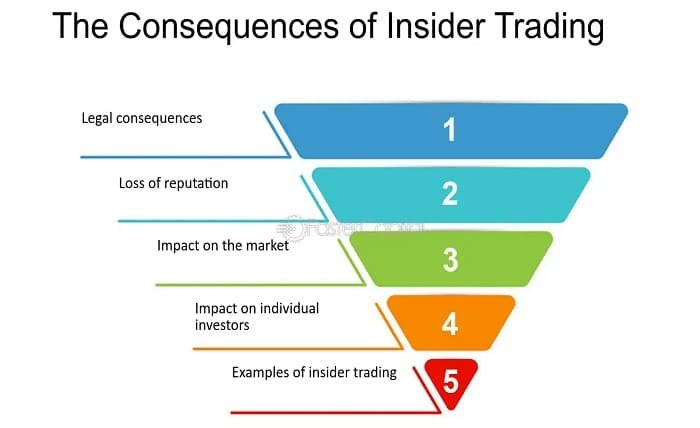

Legal and Ethical Dimensions: Regulatory Frameworks and Ethical Considerations

Overview of Laws Governing Insider Trading

Various laws aim to curb insider trading and protect market integrity. In the U.S., the Securities Exchange Act of 1934 is key. It empowers the SEC to investigate and prosecute insider trading. Violation of these laws can lead to severe penalties, including hefty fines and imprisonment. For example, Martha Stewart’s insider trading scandal resulted in a five-month prison sentence.

Ethical Implications and Corporate Governance

Beyond legalities, insider trading raises serious ethical questions. It contradicts the principles of fairness and transparency that are central to good corporate governance.

Companies are expected to foster an environment where ethical behavior is the norm. When leaders engage in insider trading, it sends a message that unethical behavior is tolerated or even rewarded. This can erode the moral fabric of the organization.

Market Consequences: The Financial Impact on Companies Engaged in Insider Trading

Short-Term vs. Long-Term Financial Consequences

Insider trading can have different financial impacts in the short and long term. In the short term, the company might see its stock prices fluctuate. Investors might panic and sell off their shares, causing a rapid decline in stock value. However, the long-term consequences can be more damaging.

Companies involved in insider trading scandals often face long-term investor distrust, which can depress stock prices for years. For example, after the Enron scandal, the company’s stock plummeted from around $90.75 to less than $1.

Investor Confidence and Market Stability

Investor confidence is crucial for market stability. When insider trading occurs, it shakes this confidence. Investors might start to question the fairness of the market, leading them to pull out their investments. This can create volatility, as seen in the aftermath of major insider trading cases. For instance, when Raj Rajaratnam of the Galleon Group was convicted of insider trading, it led to significant market tremors. Such incidents can lead to broader market instability, affecting not just the companies involved but the entire market ecosystem.

Reputational Fallout: Public Perception and Media Influence

The Role of Media in Shaping Public Perception

The media plays a powerful role in shaping public perception of insider trading. When a scandal breaks, it’s often the media that brings it to light and keeps it in the public eye. Headlines about insider trading can damage a company’s reputation overnight.

The public relies on the media for information, and negative coverage can lead to a lasting stain on a company’s image. Think of the relentless media coverage of the Lehman Brothers’ collapse.

Case Studies of Reputation Damage and Recovery

Let’s look at some real-world examples. The insider trading scandal involving ImClone Systems and its CEO, Sam Waksal, led to a massive hit on the company’s reputation. Their stock plummeted, and the company had to work hard to regain trust.

On the flip side, companies like Tyco International managed to recover after its CEO’s financial misconduct scandal by overhauling its leadership and implementing stringent ethical guidelines. These examples show that while reputation damage from insider trading can be severe, recovery is possible with dedicated efforts toward transparency and ethical business practices.

Conclusion: Navigating the Aftermath of Insider Trading

Insider trading doesn’t just break laws; it breaks trust. Companies must prioritize transparency and ethical behavior to rebuild and maintain their reputations. Investors should stay informed and vigilant, seeking advice from financial experts to navigate these complexities. Let’s keep the conversation going and learn from these incidents to foster a fairer and more trustworthy market environment.