Some people work at their respectable jobs as a source of income and also to follow their passion. Others become entrepreneurs to get their financial independence.

And if you are one of the latter and want to start your own business, the best thing to start with will be a good business structure.

Why so?

Having a well-planned business structure can benefit you in many ways, including liability when it comes to partnerships.

I mean, if you start a business, you need to be prepared for the risks, right? But a business structure like LLC can really help you.

But what is LLC in business?

Let me tell you what LLC is and what benefits you might be able to get from this kind of business structure.

What Is LLC in Business?

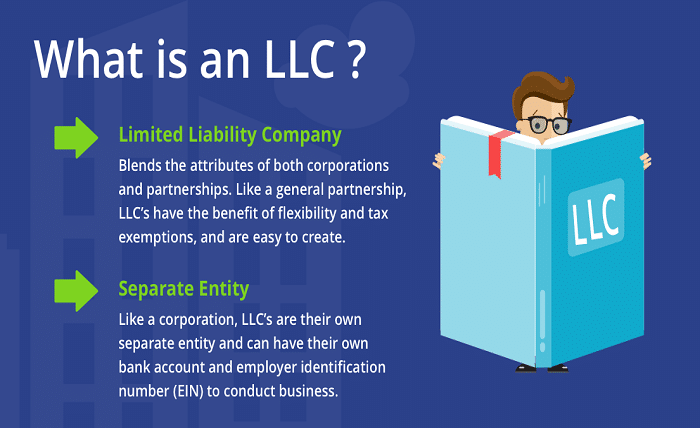

The full abbreviation of LLC is Limited Liability Company. This business structure is actually a legal entity of the U.S.

And this business structure is used to protect the owners of a business from being personally responsible for the liabilities and debts of the business.

A Limited Liability Company is actually a hybrid entity. It is one that combines the characteristics of a partnership and a corporation.

Somewhat like a corporation!

The Limited Liability Company’s business structure is a bit like the structure of a corporation. However, the fact that the members of this kind of company have access to flow-through taxation is a feature that most partnerships have.

And depending on the regulations and state statutes of a certain state vary from one state to another.

Owners are members!

This corporate-like business structure protects the members of the company from having to be pursued to repay the debts or even the liabilities of the company.

And everyone excluding insurance companies and banks gets to become a member of a Limited Liability Company.

The company’s profits are not taxed. Instead, the individual members of the company have to deal with taxes after the profits and losses have been divided.

Benefits of LLC in Business

A Limited Liability Company gets to take advantage of some of the benefits of both a corporation and a partnership.

I’ll tell you what the benefits are.

Asset Protection

As the name, Limited Liability Company, suggests, the main benefit of such a company is the protection of limited liability.

The assets of all the members of such a company will be protected from all debts and lawsuits the business might get involved in.

Taxation

If a Limited Liability Company doesn’t want to be taxed as a partnership or a sole-partnership, it can get taxed as a C-corp or an S-corp.

As a C-corp, the members can pay their taxes on their received distributions. And as an S-corp, they can pay personal income taxes on the company’s profit shares.

Versatility

A Limited Liability Company doesn’t have to uphold a board of directors or arrange annual shareholder meetings if they don’t want to.

And this kind of company doesn’t even have to stay bound by various administrative requirements that corporations do.

Flexibility of Profit Shares

The members of a Limited Liability Company get to decide how they are going to share profits among the members.

And this kind of company doesn’t need to issue dividends like corporations on stock on the basis of how many numbers of shares are owned by the members of the business.

Conclusion

What is LLC in business? The Limited Liability Company business structure is a combination of certain features of a business structure a corporation and a partnership or sole-partnership abides by.