What Are Fixed Income Mutual Funds and How Do They Work?

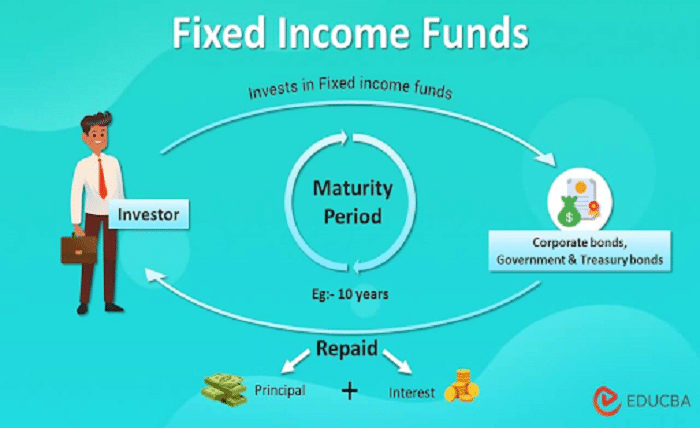

Fixed income mutual funds are investment vehicles that primarily invest in bonds, treasury bills, and other debt instruments to provide regular income and stability to investors. These funds are designed to generate consistent returns while minimizing risk, making them an attractive choice for conservative investors or those nearing retirement.

Unlike equity mutual funds that aim for growth, fixed income funds showbizztoday.com prioritize preserving capital and delivering predictable payouts. In this guide, we’ll explore everything you need to know about fixed income mutual funds, from their features to their advantages and risks.

What Are Fixed Income Mutual Funds?

Fixed income mutual funds are a type of mutual fund that pools money from investors to invest in fixed-income securities like:

- Government Bonds

- Corporate Bonds

- Treasury Bills

- Municipal Bonds

- Mortgage-Backed Securities (MBS)

The goal of these funds is to provide investors with steady income in the form of interest payments or dividends. The fund’s portfolio is managed by professional fund managers who allocate investments to achieve the fund’s stated objective, such as stability, income, or a specific duration.

How Do Fixed Income Mutual Funds Work?

- Pooling Investor Funds:

When you invest in a fixed income mutual fund, your money is pooled with that of other investors. This pooled money is used to purchase a diversified portfolio of debt instruments. - Generating Income:

The fund earns income from interest payments on the debt securities it holds. This income is distributed to investors as regular dividends. - Professional Management:

Fund managers actively manage the portfolio by analyzing market conditions, credit quality, and interest rates to ensure optimal returns while maintaining low risk. - Diversification:

These funds invest in a wide range of fixed-income assets to spread risk and reduce the impact of default by any single issuer.

Benefits of Fixed Income Mutual Funds

- Stable Returns:

- These funds are designed to provide consistent income, making them ideal for risk-averse investors.

- Diversification:

- Investing in multiple bonds reduces the risk associated with a single issuer defaulting.

- Professional Management:

- Expert fund managers handle the portfolio, saving you the hassle of researching and monitoring individual bonds.

- Liquidity:

- Unlike directly investing in bonds, fixed income mutual funds are highly liquid, allowing you to buy or sell your holdings on any business day.

- Tax Benefits (in Some Cases):

- Certain fixed income funds, like municipal bond funds, may provide tax-exempt interest income, depending on the investor’s location.

- Capital Preservation:

- These funds aim to preserve your principal investment, making them a safer choice compared to equity funds.

Types of Fixed Income Mutual Funds

- Government Bond Funds:

- Invest primarily in sovereign bonds issued by the government, offering high safety and low returns.

- Corporate Bond Funds:

- Invest in bonds issued by companies, offering higher returns than government bonds but with slightly higher risk.

- Municipal Bond Funds:

- Invest in bonds issued by state or local governments, often providing tax-exempt income for residents.

- High-Yield Bond Funds:

- Also known as junk bond funds, these invest in lower-rated bonds with higher returns but higher risk.

- Short-Term Bond Funds:

- Focus on bonds with shorter maturities, providing lower interest rate risk and greater stability.

- Intermediate and Long-Term Bond Funds:

- Invest in bonds with medium to long durations, offering higher yields but greater sensitivity to interest rate changes.

- Inflation-Protected Bond Funds:

- Invest in bonds like Treasury bizhunet Inflation-Protected Securities (TIPS) to protect against inflation risk.

How to Choose the Right Fixed Income Mutual Fund

- Understand Your Investment Goals:

- Are you looking for stability, income, or a balance between the two? Your financial goals should guide your choice.

- Evaluate Risk Tolerance:

- High-yield bond funds carry more risk compared to government or municipal bond funds. Choose a fund that matches your comfort level with risk.

- Analyze Fund Performance:

- Review historical returns and compare them with similar funds. Remember that past performance is not always indicative of future results.

- Consider Fund Expenses:

- Look at the fund’s expense ratio, as high fees can eat into your returns.

- Check Credit Quality:

- Pay attention to the credit rating of the bonds in the fund’s portfolio. Higher-rated bonds are safer but may provide lower returns.

- Look at Duration:

- A fund’s duration measures its sensitivity to interest rate changes. Shorter durations mean lower interest rate risk.

Risks of Fixed Income Mutual Funds

While fixed income mutual funds are considered low-risk, they are not risk-free. Here are the main risks to be aware of:

- Interest Rate Risk:

- When interest rates rise, bond prices fall, which can reduce the fund’s value.

- Credit Risk:

- If the issuer of a bond defaults, the fund may lose some of its value.

- Inflation Risk:

- Fixed income funds may not keep up with inflation, eroding your purchasing power over time.

- Liquidity Risk:

- Some funds may hold bonds that are difficult to sell, especially during market downturns.

Who Should Invest in Fixed Income Mutual Funds?

Fixed income mutual funds are suitable for:

- Conservative Investors: Those looking for stable and predictable returns with minimal risk.

- Retirees: Individuals who need steady income to supplement their retirement savings.

- Diversifiers: Investors seeking to balance their portfolio by adding low-risk assets.

- Short-Term Goal Planners: Those saving for a specific goal within a few years.

Tax Implications of Fixed Income Mutual Funds

- Interest Income Taxation:

- Dividends from fixed income funds are typically taxed as ordinary income.

- Capital Gains Tax:

- If you sell your mutual fund units for a profit, you may owe short- or long-term capital gains tax.

- Tax-Free Options:

- Some funds, like municipal bond funds, may offer tax-free interest income, depending on your jurisdiction.

Steps to Invest in Fixed Income Mutual Funds

- Research Funds:

- Use online tools to compare funds based on performance, expenses, and credit quality.

- Choose a Fund:

- Select a fund that aligns with your financial goals and risk tolerance.

- Open an Account:

- Create an account with a mutual fund company or through an investment platform.

- Invest and Monitor:

- Start with an initial investment, set up SIPs (Systematic Investment Plans) if available, and monitor your portfolio regularly.

FAQs

- Are fixed income mutual funds safe?

Yes, they are relatively safe compared to equity funds, but they still carry risks like interest rate and credit risk. - What is the average return of fixed income mutual funds?

Returns vary but generally range from 3% to 6%, depending on the fund type and market conditions. - Can I lose money in fixed income funds?

Yes, if interest rates rise sharply or if the issuer defaults, the fund’s value may decrease. - Are fixed income funds good for long-term goals?

They are more suited for short- to medium-term goals, as their returns may not outpace inflation over the long term.

Conclusion

Fixed income mutual funds are an excellent option for investors seeking stability, predictable income, and diversification. Whether you’re a retiree or a conservative investor, these funds offer a reliable way to achieve your financial goals. By understanding how they work and carefully selecting the right fund, you can make the most of this low-risk investment opportunity.