The Small Cap Index is a crucial component in the world of stock market investing. It tracks the performance of small-cap companies, which are typically businesses with a market capitalization ranging from $300 million to $2 billion. Investors often turn to the Small Cap Index as a way to diversify their portfolios and capture the growth potential of smaller companies. In this comprehensive guide, we’ll explore the mechanics of the Small Cap Index, its benefits, risks, and strategies for investing.

What is a Small Cap Index?

The Small Cap Index is a collection of stocks that represent small-cap companies. These businesses are generally considered to be at an earlier stage of growth compared to their larger counterparts. The Small Cap Index is often used as a benchmark to measure the performance of these smaller firms. One of the most well-known Small Cap Indexes is the Russell 2000, which includes 2,000 of the smallest companies in the U.S. stock market.

Why Invest in the Small Cap Index?

Investing in the Small Cap Index offers several potential benefits. One of the main attractions is the opportunity for higher returns. Since small-cap companies are typically in their growth phases, they have the potential to deliver significant gains. Additionally, the Small Cap Index provides diversification, as it includes a broad range of industries and sectors. However, it’s essential to remember that investing in the Small Cap Index also comes with increased volatility and risk.

How Does the Small Cap Index Work?

The Small Cap Index works by tracking the performance of a specific group of small-cap companies. Each company in the index is weighted based on its market capitalization, meaning larger small-cap firms have more influence on the index’s overall performance. The Small Cap Index is updated regularly to reflect changes in market value and to add or remove companies as they grow or shrink in size.

Key Features of the Small Cap Index

The Small Cap Index is characterized by several key features:

- Market Capitalization: The companies included in the Small Cap Index typically have a market cap between $300 million and $2 billion.

- Diversification: The Small Cap Index covers a wide range of sectors, providing exposure to different parts of the economy.

- Volatility: Small-cap stocks tend to be more volatile than large-cap stocks, which can lead to both higher potential rewards and risks.

These features make the Small Cap Index an attractive yet challenging investment option for many.

Differences Between Small Cap, Mid Cap, and Large Cap Indexes

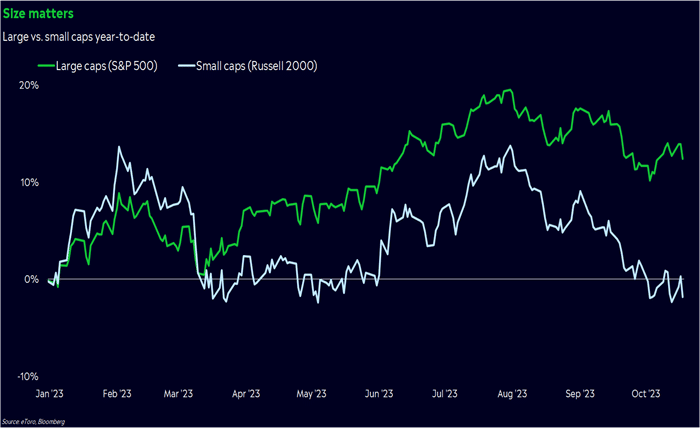

The Small Cap Index differs significantly from mid-cap and large-cap indexes. While the Small Cap Index focuses on smaller companies, mid-cap indexes track companies with a market capitalization between $2 billion and $10 billion. Large-cap indexes, like the S&P 500, track companies with market capitalizations exceeding $10 billion. Each index type offers different levels of risk, reward, and volatility, with the Small Cap Index generally being the most volatile but potentially offering the highest returns.

Historical Performance of the Small Cap Index

The historical performance of the Small Cap Index has been marked by both periods of rapid growth and sharp declines. Over the long term, the Small Cap Index has outperformed many large-cap indexes, thanks to the growth potential of smaller companies. However, small-cap stocks are also more susceptible to economic downturns, which can lead to significant short-term volatility. Investors interested in the Small Cap Index should be prepared for fluctuations in performance.

Risks Associated with the Small Cap Index

While the Small Cap Index offers the potential for high returns, it also carries several risks. One of the primary risks is volatility. Small-cap stocks tend to fluctuate more than large-cap stocks, meaning that the Small Cap Index can experience large swings in value. Additionally, small-cap companies may have less financial stability than their larger counterparts, making them more vulnerable to economic downturns. Investors should carefully consider these risks before investing in the Small Cap Index.

Benefits of Investing in the Small Cap Index

Despite the risks, there are numerous benefits to investing in the Small Cap Index. For one, small-cap stocks often have greater growth potential than larger companies. This is because smaller companies can expand rapidly as they capture new markets or introduce innovative products. Additionally, the Small Cap Index offers diversification, as it includes companies from a wide range of industries. Over the long term, this can help reduce the overall risk of a portfolio.

How to Invest in the Small Cap Index

Investing in the Small Cap Index is relatively straightforward. Investors can gain exposure to the index through exchange-traded funds (ETFs) or mutual funds that track the performance of the Small Cap Index. These investment vehicles allow investors to buy shares in a fund that holds all the companies in the index, providing broad exposure to small-cap stocks without the need to buy individual stocks. It’s important to choose the right ETF or mutual fund to match your investment goals and risk tolerance.

Small Cap Index ETFs and Mutual Funds

There are several popular ETFs and mutual funds that track the Small Cap Index. One of the most well-known is the iShares Russell 2000 ETF (IWM), which mirrors the performance of the Russell 2000 Index. Other options include the Vanguard Small-Cap ETF (VB) and the SPDR S&P 600 Small Cap ETF (SLY). These funds offer a convenient way for investors to gain exposure to the Small Cap Index without having to manage a portfolio of individual small-cap stocks.

Small Cap Index vs. Individual Small-Cap Stocks

Investing in the Small Cap Index is different from investing in individual small-cap stocks. When you invest in the Small Cap Index, you are essentially buying a basket of small-cap stocks, which provides diversification and reduces the risk associated with any single company. On the other hand, investing in individual small-cap stocks allows for more focused investments in specific companies but comes with higher risk. Both approaches have their pros and cons, depending on an investor’s goals and risk tolerance.

The Role of the Small Cap Index in Portfolio Diversification

The Small Cap Index plays a vital role in portfolio diversification. By including small-cap stocks in a portfolio, investors can reduce their overall risk and potentially increase their returns. The Small Cap Index offers exposure to companies that may not be included in large-cap indexes like the S&P 500, providing a broader view of the market. However, it’s essential to balance the Small Cap Index with other asset classes to create a well-diversified portfolio.

Market Trends Affecting the Small Cap Index

Like all stock market investments, the Small Cap Index is influenced by broader market trends. Small-cap stocks tend to perform well during periods of economic expansion when consumer spending and business investment are high. Conversely, the Small Cap Index may underperform during economic downturns, as smaller companies often have less financial stability than larger corporations. Keeping an eye on market trends can help investors make informed decisions about their exposure to the Small Cap Index.

Conclusion

The Small Cap Index is a powerful tool for investors looking to diversify their portfolios and capture the growth potential of smaller companies. While investing in the Small Cap Index offers opportunities for high returns, it also comes with increased volatility and risk. By understanding how the Small Cap Index works, its benefits, and its risks, investors can make informed decisions about whether it fits into their long-term investment strategy.

FAQs

1. What is the Small Cap Index?

The Small Cap Index is a stock market index that tracks the performance of small-cap companies, typically with a market capitalization between $300 million and $2 billion.

2. Is investing in the Small Cap Index risky?

Yes, investing in the Small Cap Index can be riskier than large-cap stocks due to higher volatility. However, it also offers the potential for greater returns over time.

3. How can I invest in the Small Cap Index?

You can invest in the Small Cap Index through ETFs or mutual funds that track the performance of the index, such as the iShares Russell 2000 ETF or Vanguard Small-Cap ETF.

4. Why is the Small Cap Index important for diversification?

The Small Cap Index offers exposure to a broad range of smaller companies, which can diversify your portfolio and reduce overall risk when balanced with other asset classes.

5. How does the Small Cap Index compare to the S&P 500?

The Small Cap Index tracks smaller companies than the S&P 500, which focuses on large-cap stocks. The Small Cap Index tends to be more volatile but offers higher growth potential.