Introduction

Sensex historical data is crucial for both novice and seasoned investors who wish to navigate the complexities of the stock market. This data offers invaluable insights into past market behaviors, helping to predict future trends and making informed investment decisions.

The Origin of Sensex and Its Importance

The Sensex, short for the Sensitive Index, was introduced by the Bombay Stock Exchange in 1986. It represents the stock prices of 30 financially sound and well-established companies listed on BSE. Analyzing Sensex historical data helps investors understand market trends, evaluate economic health, and make strategic investment choices.

Key Milestones in Sensex History

Over the years, the Sensex has witnessed significant milestones that have shaped the Indian economy. From its modest beginning to reaching unprecedented highs, the Sensex historical data chronicles each pivotal moment, reflecting broader economic shifts within India and globally.

Analyzing Decade-wise Trends in Sensex Data

Decade-wise analysis of Sensex historical data reveals patterns of growth, stagnation, and occasional declines. Each decade reflects the economic and political climates of the times, offering insights into how external factors like global economic crises, political stability, and technological advancements affect the market.

Technological Impact on Sensex Performance

The infusion of technology in trading and data analysis has dramatically impacted Sensex performance. Advanced analytics and trading algorithms have enabled quicker responses to market changes, as reflected in the Sensex historical data. This section explores how technology has streamlined trading and influenced market behavior.

The Role of Economic Policies on Sensex Trajectory

Government economic policies play a pivotal role in shaping market trends. Reforms such as liberalization, privatization, and globalization have had profound impacts on the Sensex, driving significant surges and drops in the market, as documented in Sensex historical data.

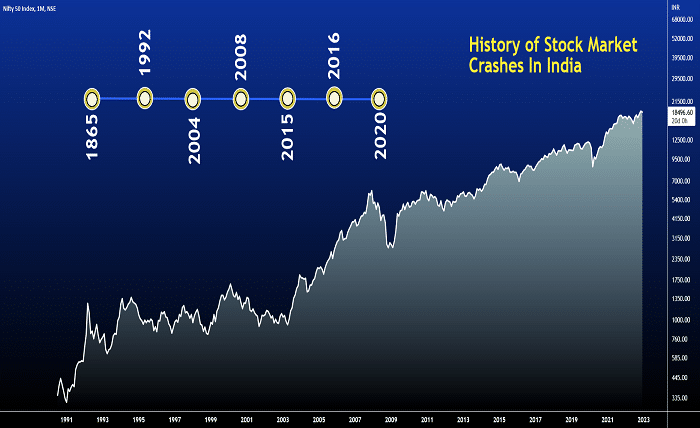

Global Events and Their Impact on Sensex

Global events such as the 2008 financial crisis, the 2020 pandemic, and geopolitical tensions significantly influence the Sensex. By examining Sensex historical data during these periods, investors can see how international dynamics play out on domestic fronts.

Sensex Corrections: A Historical Overview

Market corrections are a natural part of stock market dynamics. This section reviews major corrections in the history of Sensex, analyzing the causes, effects, and recovery patterns as shown in Sensex historical data.

Predictive Analysis Using Historical Sensex Data

Leveraging Sensex historical data for predictive analysis is a powerful tool for investors. Techniques like regression analysis, moving averages, and machine learning models can forecast future movements based on historical trends.

How Investors Use Sensex Historical Data

Investors rely on Sensex historical data for various purposes, including risk management, strategic planning, and identifying investment opportunities. This data aids in constructing diversified portfolios and anticipating market movements.

Conclusion

Sensex historical data is more than just numbers; it’s a mirror reflecting the economic, political, and global influences on the Indian stock market. Understanding these patterns helps investors make more informed decisions, ensuring better preparedness for future market fluctuations.

FAQs

- What is the Sensex?

- The Sensex is an index that measures the stock performance of 30 well-established companies listed on the Bombay Stock Exchange (BSE).

- Why is analyzing Sensex historical data important?

- Analyzing this data helps understand market trends, assess economic health, and make informed investment decisions.

- How can Sensex historical data predict future market trends?

- By applying statistical and machine learning techniques to historical data, analysts can forecast future market behaviors.

- What significant global event had a major impact on the Sensex?

- The 2008 global financial crisis had a significant impact, causing substantial volatility and decline in the Sensex.

- Can Sensex historical data help in personal investment planning?

- Yes, by understanding market trends and historical performances, investors can better strategize their investment portfolios to minimize risks and maximize returns.