Intraday Trading Tips in Hindi: Master the Market Today

Intraday trading can be exciting and rewarding. It involves buying and selling stocks within the same day.

For those who prefer learning in Hindi, this blog post is for you. Intraday trading requires quick decisions and a good strategy. Many beginners struggle due to lack of guidance. This post aims to help you with practical intraday trading tips, explained in Hindi.

Understanding the market trends and knowing when to enter or exit a trade are crucial. We will break down complex strategies into simple, easy-to-follow steps. This guide will help you navigate the fast-paced world of intraday trading with confidence. Stay tuned to learn effective tips that can enhance your trading skills and improve your chances of success.

Introduction To Intraday Trading

Intraday trading is a popular trading strategy. It involves buying and selling stocks within the same day. For many, it offers the excitement of quick profits. But it also requires knowledge and strategy. Let’s dive into the basics of intraday trading.

What Is Intraday Trading?

In simple terms, intraday trading means trading stocks within a single day. Traders aim to take advantage of small price movements. They buy stocks at a low price and sell them at a higher price before the market closes.

This type of trading requires constant monitoring of the market. Traders use technical analysis and charts. They make quick decisions based on market trends. Intraday trading is not for everyone. It demands discipline, patience, and a clear strategy.

Importance Of Intraday Trading

Intraday trading offers several benefits. First, it allows traders to capitalize on short-term price movements. This can lead to quick profits. Second, it eliminates the risk of overnight market changes. Traders close their positions by the end of the day.

Third, intraday trading can provide liquidity to the market. Active traders help keep the market dynamic. Lastly, it offers opportunities for learning and growth. Traders can improve their skills and strategies through daily practice.

While intraday trading has its advantages, it also comes with risks. The fast-paced nature of the market can lead to losses. Therefore, understanding the basics and having a solid plan is crucial.

Essential Tools

Intraday trading demands a keen eye and the right tools. To succeed, traders must equip themselves with essential tools. These tools help make informed decisions, track market trends, and execute trades efficiently.

Trading Platforms

Choosing the right trading platform is crucial. A good platform provides real-time data, seamless execution, and a user-friendly interface. Here are some popular trading platforms:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- TradingView

- ThinkorSwim

- eToro

Each platform has unique features. MT4 and MT5 offer advanced charting tools. TradingView is known for its community-driven ideas and robust charting. ThinkorSwim provides extensive analysis tools. eToro is user-friendly for social trading.

Technical Indicators

Technical indicators are essential for analyzing market movements. They help predict price trends and identify entry and exit points. Some widely used technical indicators include:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Bollinger Bands

- MACD (Moving Average Convergence Divergence)

- Fibonacci Retracement

Moving Averages smooth out price data to identify trends. RSI measures the speed and change of price movements. Bollinger Bands show volatility and potential price breakouts. MACD reveals changes in strength, direction, momentum, and duration of a trend. Fibonacci Retracement helps identify potential support and resistance levels.

Using these tools effectively can enhance trading strategies. Combining multiple indicators can provide a clearer market picture.

Market Analysis Techniques

For successful intraday trading, understanding market analysis techniques is crucial. These techniques help traders make informed decisions. This section explains two key methods: Fundamental Analysis and Technical Analysis.

Fundamental Analysis

Fundamental Analysis involves evaluating a company’s financial health. This method looks at:

- Balance Sheets: Assess the company’s assets and liabilities.

- Income Statements: Check revenues and expenses.

- Cash Flow Statements: Understand cash inflows and outflows.

Traders also consider external factors:

- Economic Conditions: Analyze the overall economy’s health.

- Industry Trends: Track trends within the industry.

- Company News: Stay updated with company-specific news.

Using this information, traders can predict stock movements. They identify undervalued or overvalued stocks for intraday trades.

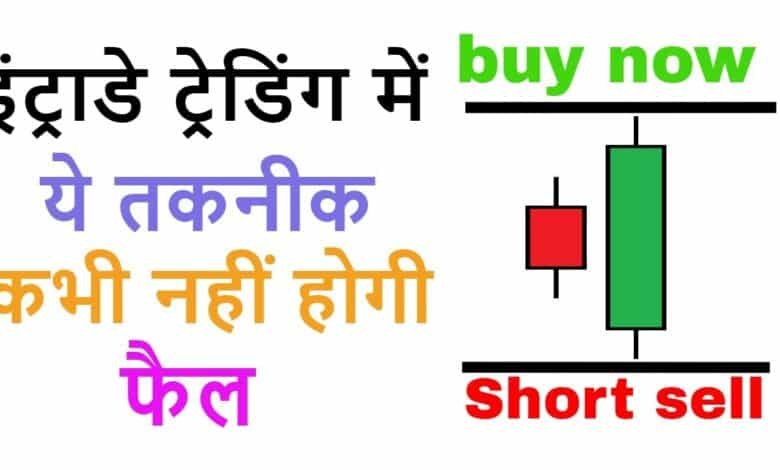

Technical Analysis

Technical Analysis focuses on historical price data and trading volumes. This method uses charts and indicators to predict future price movements. Key tools include:

- Price Charts: Line, bar, and candlestick charts display price history.

- Moving Averages: Identify trends by smoothing price data.

- Relative Strength Index (RSI): Measure stock’s speed and change of price movements.

Other important indicators:

- Bollinger Bands: Indicate volatility and potential price reversals.

- MACD (Moving Average Convergence Divergence): Show changes in strength, direction, momentum, and duration of a trend.

Technical Analysis provides visual insights into market behavior. It helps traders time their entries and exits accurately.

Credit: www.somosprocurico.cl

Risk Management Strategies

Risk management is crucial in intraday trading. Without it, traders risk losing significant amounts of money. Effective risk management strategies help safeguard investments and ensure long-term success. Here are some essential tips for managing risks in intraday trading.

Setting Stop-loss

Setting a stop-loss order is vital. It helps limit potential losses. Decide on a stop-loss level before entering a trade. It ensures you exit the trade if the market moves against you. This prevents emotional decision-making during volatile market conditions. Stick to your predetermined stop-loss levels for each trade.

Diversifying Trades

Diversifying your trades reduces risk. Do not put all your capital in one trade. Spread your investments across different stocks or sectors. This way, if one trade performs poorly, others may balance the loss. Diversification helps in managing overall risk and increasing the chances of profitability.

Trading Psychology

In the world of intraday trading, psychology plays a crucial role. A trader’s mindset can impact their decisions and ultimately their success. Understanding and managing trading psychology is essential for consistent profits.

Controlling Emotions

Emotions can often cloud judgment in trading. Fear and greed are the biggest emotions to control. Fear can make a trader exit trades too early. Greed can cause them to hold onto losing positions. To control emotions, it’s essential to stick to a pre-defined strategy.

Use tools like stop-loss orders to manage risk. These tools can help in reducing emotional decisions. Regular breaks during trading sessions can also help in maintaining calm. Meditation and breathing exercises can be beneficial too.

Maintaining Discipline

Discipline is key in intraday trading. It helps in sticking to the trading plan. Without discipline, traders may deviate from their strategy. This can lead to significant losses.

Create a trading plan before starting the day. Set clear entry and exit points. Always adhere to these points, regardless of market conditions. Avoid chasing after quick profits. Patience and consistency are vital for long-term success.

Keep a trading journal to track your trades. Review and analyze them regularly. This practice helps in identifying mistakes and improving strategies. Staying disciplined can lead to better decision-making and improved trading performance.

Effective Trading Strategies

Effective trading strategies are crucial for success in intraday trading. These strategies help traders make informed decisions and minimize risks. Below are some effective trading strategies that can enhance your intraday trading experience.

Scalping

Scalping is a popular intraday trading strategy. It involves making quick trades to capture small price movements. Traders using this strategy often make multiple trades in a day. The goal is to accumulate small profits that add up over time. Scalpers need to act fast and have a good understanding of market trends. This strategy requires constant monitoring of the market. It is ideal for traders who can devote a lot of time to trading.

Momentum Trading

Momentum trading is another effective intraday strategy. It focuses on stocks showing strong movement in one direction. Traders buy stocks that are rising and sell stocks that are falling. The idea is to ride the momentum until it shows signs of reversal. This strategy relies on identifying trends early. Traders must have a keen eye for spotting momentum shifts. It is best suited for those who can analyze market data quickly.

Case Studies

Case studies provide real-world examples of intraday trading. They help traders learn from both successes and mistakes. By examining these cases, traders can develop better strategies. These examples show how different approaches can lead to different outcomes. They are a valuable resource for anyone looking to improve their intraday trading skills.

Successful Trades

Successful trades often follow a clear strategy. Traders who succeed usually stick to their plan. They set target prices and stop-loss limits. One example is a trader who bought shares of a tech company at a low price. The company’s stock rose due to positive news. The trader sold the shares at a high price, making a profit.

Another example is a trader who used technical analysis. They noticed a pattern in the stock’s price movements. By buying at a certain point and selling at another, they made a successful trade. These case studies show the importance of planning and analysis in intraday trading.

Common Mistakes

Common mistakes in intraday trading can lead to losses. One frequent error is not setting a stop-loss limit. This can result in significant losses if the stock price drops unexpectedly. Another mistake is trading based on emotions. Fear and greed can cloud judgment, leading to poor decisions.

Some traders fail to do proper research. They might buy a stock based on rumors or tips. This often leads to losses when the stock does not perform as expected. Another common mistake is overtrading. Trying to make too many trades in a day can lead to errors and losses. Learning from these mistakes can help traders avoid them in the future.

Credit: www.quora.com

Tips For Beginners

Intraday trading offers exciting opportunities for beginners. It involves buying and selling stocks within the same trading day. This strategy requires quick decisions and a good understanding of the market. Beginners should follow some essential tips to improve their chances of success.

Starting Small

Beginners should start with a small investment. This approach helps to manage risks better. Investing a large sum can lead to significant losses. It’s wise to gain experience before increasing the investment amount. Small investments allow beginners to learn the ropes without losing too much money.

Learning Continuously

Continuous learning is crucial in intraday trading. The stock market is dynamic and ever-changing. Beginners should stay updated with market trends and news. Reading books and taking courses can enhance knowledge. Joining forums and groups also provides valuable insights. This continuous learning helps in making informed decisions.

Credit: www.indiamart.com

Frequently Asked Questions

What Is Intraday Trading In Hindi?

Intraday trading in Hindi means buying and selling stocks within a single trading day.

How To Start Intraday Trading?

To start intraday trading, open a trading account, learn market basics, and develop a strategy.

What Are Some Intraday Trading Tips?

Some intraday trading tips include setting stop-loss, choosing liquid stocks, and staying updated with market news.

Why Is Stop-loss Important In Intraday Trading?

Stop-loss is important because it limits potential losses by automatically selling a stock at a predetermined price.

Conclusion

Intraday trading can be rewarding with the right tips. Practice regularly and learn from mistakes. Stay updated with market trends. Use stop-loss orders to minimize risk. Manage your emotions while trading. Always have a clear strategy. Focus on high-volume stocks.

Keep your trading simple and disciplined. Happy trading!