Introduction:

The Harshad Mehta scandal of the 1990s marked a watershed moment in Indian financial history. Harshad Mehta, a stockbroker from Mumbai, captivated the nation with his unprecedented rise in the stock market, only to be later embroiled in a massive financial scandal. This article explores the fascinating tale of Harshad Mehta and the bull run he orchestrated, shedding light on the events that unfolded and their lasting impact on India’s financial landscape.

The Rise of Harshad Mehta:

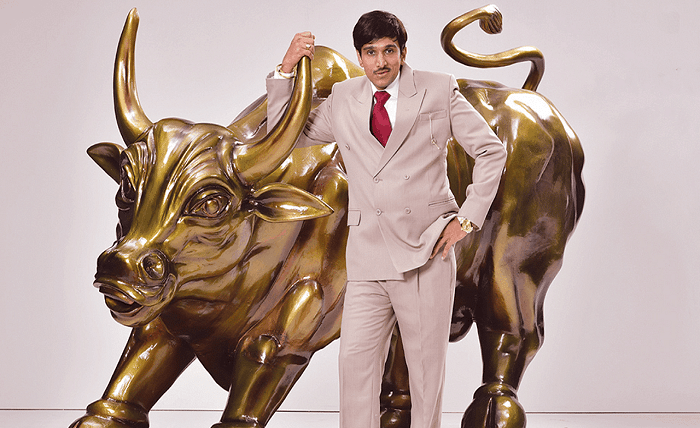

In the late 1980s and early 1990s, Harshad Mehta emerged as a prominent figure in the Indian stock market. His unconventional investment strategies, combined with his charismatic personality, earned him the nickname “Big Bull.” Mehta was known for his ability to manipulate stock prices and engineer a bull run that sent the Bombay Stock Exchange (BSE) soaring to new heights.

The Bull Run:

Harshad Mehta’s modus operandi involved exploiting loopholes in the banking system to fund his stock market operations. He devised a scheme known as the “ready forward” (RF) deal, where he used bank receipts to manipulate the price of select stocks. Mehta’s buying spree led to a surge in stock prices, creating a frenzy among investors. The media hailed him as a financial wizard, and his popularity skyrocketed.

The Fallout:

As Mehta’s influence and wealth grew, so did the risks he took. In 1992, the scam finally came to light when it was discovered that Mehta had orchestrated a massive securities scam, involving the misappropriation of funds from various banks. The revelation sent shockwaves through the financial sector, exposing the vulnerabilities of the Indian banking system and the loopholes in stock market regulation.

Legal Battle and Aftermath: Harshad Mehta’s actions led to a wave of investigations and legal proceedings. He was arrested and faced multiple charges related to fraud, forgery, and conspiracy. The scandal also exposed corruption and collusion between influential individuals and financial institutions. Mehta’s trial and subsequent appeals stretched over several years before his death in 2001.

Legacy and Lessons Learned:

The Harshad Mehta scandal had far-reaching implications for the Indian economy and financial markets. The incident prompted significant reforms in the banking and stock market sectors, including the establishment of the Securities and Exchange Board of India (SEBI) to regulate and monitor the stock market. The event also highlighted the need for stricter regulations, transparency, and investor protection in the Indian financial system.

Read more about Daughter of Kevin Samuels

Conclusion:

The Harshad Mehta scandal remains etched in Indian financial history as a cautionary tale of greed, manipulation, and the consequences of unchecked power. While the bull run orchestrated by Mehta captivated the nation and temporarily boosted investor sentiment, it ultimately led to a massive financial scandal that exposed systemic flaws. The aftermath of the scam resulted in significant reforms and regulatory changes, shaping India’s financial landscape for years to come. It serves as a reminder of the importance of ethical practices, transparency, and robust regulations to maintain trust and stability in the financial markets.

FAQ: Harshad Mehta and the Bull Run

- Who is Harshad Mehta?

Harshad Mehta was an Indian stockbroker who rose to prominence in the late 1980s and early 1990s. He gained fame for orchestrating a bull run in the stock market and manipulating stock prices using a scheme known as the “ready forward” (RF) deal. - What was the bull run orchestrated by Harshad Mehta?

The bull run refers to a period in the Indian stock market when stock prices experienced a significant and sustained upward movement. Harshad Mehta’s manipulative tactics led to a surge in stock prices, creating a frenzy among investors and attracting widespread media attention. - How did Harshad Mehta manipulate the stock market?

Mehta manipulated the stock market by exploiting loopholes in the banking system. He used the RF deal, where he used bank receipts to inflate the prices of select stocks. This led to a rise in the overall market index and fueled investor enthusiasm. - What led to the exposure of the Harshad Mehta scandal?

The Harshad Mehta scandal was exposed in 1992 when it was discovered that Mehta had orchestrated a massive securities scam. The scam involved the misappropriation of funds from various banks, revealing the weaknesses in the banking system and inadequate stock market regulation. - What were the consequences of the Harshad Mehta scandal?

The scandal had far-reaching consequences for India’s financial sector. It exposed the vulnerabilities of the banking system, highlighted the need for stricter regulations, and led to significant reforms in the stock market. The event also resulted in the establishment of the Securities and Exchange Board of India (SEBI) to regulate and monitor the stock market. - What legal actions were taken against Harshad Mehta?

Following the exposure of the scam, Harshad Mehta faced multiple charges related to fraud, forgery, and conspiracy. He was arrested and underwent a lengthy trial and subsequent appeals. The legal battle continued for several years until his death in 2001. - How did the Harshad Mehta scandal impact the Indian economy?

The scandal had a profound impact on the Indian economy. It eroded investor confidence, leading to a temporary downturn in the stock market. However, it also prompted significant reforms and regulatory changes, which aimed to strengthen the financial system, increase transparency, and protect investor interests. - What lessons can be learned from the Harshad Mehta scandal?

The Harshad Mehta scandal serves as a reminder of the importance of ethical practices, transparency, and robust regulations in the financial sector. It underscores the need for effective oversight and regulation to prevent fraud and maintain trust and stability in the markets. - Are there any similar incidents that have occurred since the Harshad Mehta scandal?

While there have been other financial scandals and fraud cases in India since the Harshad Mehta scandal, none have achieved the same level of magnitude or widespread impact. However, the incident continues to be referenced as a benchmark in India’s financial history. - How does the Harshad Mehta scandal continue to influence India’s financial landscape today?

The Harshad Mehta scandal played a pivotal role in shaping India’s financial landscape. It led to significant reforms, including stricter regulations, improved oversight, and the establishment of regulatory bodies such as SEBI. These measures have contributed to greater transparency and stability in India’s financial markets.