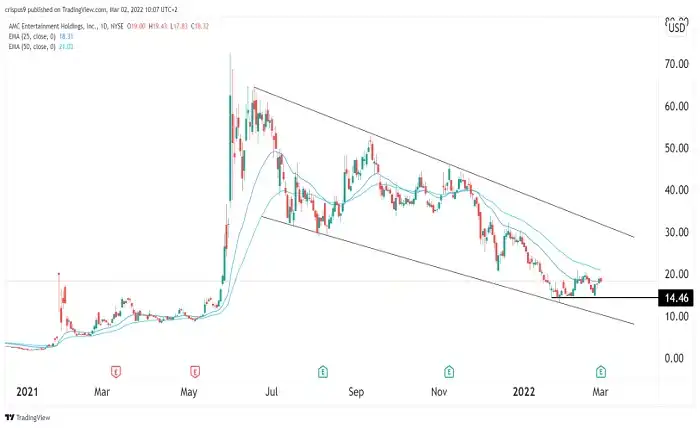

AMC Entertainment Holdings (AMC) is the world’s largest movie theater chain, with over 10,000 screens in more than 900 theaters across the globe. The company has been in the spotlight since late 2020, when a group of retail investors from Reddit’s r/Wall Street Bets community started buying and holding AMC shares, causing a massive surge in the stock price and a short squeeze on the hedge funds that were betting against it. AMC stock reached an all-time high of $72.62 on June 2, 2021, up from around $2 at the end of 2020. However, since then, the stock has been volatile and fluctuating between $10 and $40. What are the factors that influence AMC’s stock price and performance? What are the challenges and opportunities that AMC faces in the post-pandemic era? What are the analysts’ opinions and predictions on AMC stock? In this blog post, we will try to answer these questions and provide some insights on AMC stock forecasts.

The Bull Case for AMC Stock

The bull case for AMC stock is based on the following arguments:

- AMC has a loyal and passionate fan base that supports the company and its management. The retail investors who bought AMC shares are not only motivated by profits, but also by a sense of community and a desire to challenge the Wall Street establishment. They call themselves “apes” and refer to AMC as their “gorilla” or “moon” stock. They use social media platforms such as Reddit, Twitter, YouTube, and Stocktwits to share their opinions, analysis, news, memes, jokes, and questions about AMC stock. They also create or join groups or rooms that focus on specific topics or themes related to AMC stock. They often express their gratitude and admiration for Adam Aron, the CEO of AMC, who has been engaging with them through tweets, interviews, and shareholder meetings. They also participate in various initiatives and events that aim to boost AMC’s revenue and reputation, such as buying gift cards, merchandise, concessions, or tickets for themselves or others, donating to charities, voting for board members, or attending special screenings or premieres.

- AMC has a strong competitive advantage in the movie theater industry. The company is the market leader in terms of revenue, screens, theaters, and market share in the US and globally. The company has a diversified portfolio of brands, formats, locations, and offerings that cater to different customer segments and preferences. The company also has a strategic partnership with Universal Pictures that allows it to show its movies exclusively in theaters for at least 17 days before they are available on streaming platforms. The company also has a popular loyalty program called AMC Stubs that has over 23 million members who enjoy benefits such as discounts, rewards, free upgrades, priority access, and special offers.

- AMC has a promising growth potential in the post-pandemic era. The company has been recovering from the devastating impact of the COVID-19 pandemic that forced it to close most of its theaters for several months in 2020 and 2021. The company has been reopening its theaters gradually as vaccination rates increase and restrictions ease in different regions. The company has also been implementing various health and safety measures such as enhanced cleaning protocols, reduced seating capacity, mandatory mask wearing, contactless ticketing and payment, etc. to ensure the well-being of its guests and employees. The company has also been taking advantage of its increased cash position and reduced debt burden thanks to its successful capital raising efforts and debt restructuring deals. The company has been using its funds to invest in new technologies, acquisitions, renovations, expansions, etc. to improve its operational efficiency and customer experience. The company has also been benefiting from the pent-up demand for out-of-home entertainment and the strong pipeline of blockbuster movies that are expected to attract large audiences in the coming months and years.

Read more about AMC Stocktwits: A Social Network for Trading AMC Stock

The Bear Case for AMC Stock

The bear case for AMC stock is based on the following arguments:

- AMC’s stock price is detached from its fundamentals and driven by hype and speculation. The retail investors who bought AMC shares are not rational or informed, but rather emotional and impulsive. They are influenced by social media influencers, celebrities, or media outlets that spread misinformation, rumors, or false hopes about AMC stock. They are also prone to manipulation by market makers, hedge funds, or other entities that have ulterior motives or hidden agendas regarding AMC stock. They are also subject to herd mentality, FOMO (fear of missing out), or panic selling that can cause sudden spikes or drops in the stock price without any logical reason. They are also ignoring or overlooking the financial reality and challenges that AMC faces, such as its negative earnings, low revenue, high debt, dilution risk, etc.

- AMC faces fierce competition and disruption in the movie theater industry. The company is not only competing with other movie theater chains, but also with streaming platforms, home entertainment systems, video games, or other forms of entertainment that offer more convenience, affordability, variety, or quality to consumers. The company is also facing the threat of changing consumer behavior and preferences that may reduce the demand for movie-going or alter the way people watch movies. The company is also facing the risk of losing its exclusive window or bargaining power with movie studios that may decide to release their movies simultaneously or earlier on streaming platforms or other channels. The company is also facing the uncertainty and volatility of the COVID-19 pandemic that may cause new variants, outbreaks, lockdowns, or regulations that may affect its operations or performance.

- AMC has a bleak outlook and limited upside potential in the post-pandemic era. The company has been overvalued and overhyped by the retail investors who have inflated its stock price to unsustainable levels that do not reflect its true worth or potential. The company has been trading at a high multiple of its sales, earnings, or book value that is not justified by its growth prospects or profitability. The company has also been facing downward pressure from analysts who have issued low ratings, price targets, or forecasts for AMC stock. The company has also been facing legal, regulatory, or ethical issues that may damage its reputation or expose it to lawsuits or sanctions. The company has also been facing technical, operational, or strategic challenges that may hinder its recovery or growth.

Conclusion

AMC Entertainment Holdings (AMC) is the world’s largest movie theater chain, with over 10,000 screens in more than 900 theaters across the globe. The company has been in the spotlight since late 2020, when a group of retail investors from Reddit’s r/Wall Street Bets community started buying and holding AMC shares, causing a massive surge in the stock price and a short squeeze on the hedge funds that were betting against it. AMC stock reached an all-time high of $72.62 on June 2, 2021, up from around $2 at the end of 2020. However, since then, the stock has been volatile and fluctuating between $10 and $40.